Get Option Data from Yahoo with Pandas

[option pandas finance This notebook shows how to read the option chain data from Yahoo finance with Pandas. Especially we will use pandas.read_html.

Import some Libraries

First, let us import some library

import pandas as pd

from matplotlib import pyplot as plt

import matplotlib

from datetime import datetime

import numpy as np

%matplotlib inline

plt.rcParams['figure.figsize'] = [20, 10]

Get the Right Url

If we want to get Tesla option data for Mar 5th 2021 from Yahoo finance, we need to visit this url https://finance.yahoo.com/quote/TSLA/options?date=1614902400. TSLA is the ticket name for Tesla and 1614902400 is the unix epoch seconds for Mar 5th 2021. So we have this function

def get_url(tick: str, year: int, month: int, day: int) -> str:

"""Get url for the Yahoo option chain table"""

date = int(datetime(year, month, day).timestamp())

tick = tick.upper()

return f"https://finance.yahoo.com/quote/{tick}/options?date={date}"

Read Option Data from HTML

Pandas provide a function called read_html which supports import data from web page. This is very convenient if the data you are interested at is well structured in the web page, e.g., a table. This function searches for <table> elements and only for <tr> and <th> rows and <td> elements within each <tr> or <th> element in the table. <td> stands for “table data”. The function signature is:

def read_html(io, match='.+', flavor=None, header=None, index_col=None,

skiprows=None, attrs=None, parse_dates=False,

tupleize_cols=None, thousands=',', encoding=None,

decimal='.', converters=None, na_values=None,

keep_default_na=True, displayed_only=True):

Some important parameters:

- io: A URL, a file-like object, or a raw string containing HTML.

- match: str or compiled regular expression, optional. The set of tables containing text matching this regex or string will be returned.

.+means nonempty string - flavor: parser of the table. Leave the default one

- header: The row (or list of rows for a

MultiIndex) to use to make the columns headers. Leave the default one - index_col: The column (or list of columns) to use to create the index. Leave the default one

- skiprows: 0-based. Number of rows to skip after parsing the column integer.

- attrs: This is a dictionary of attributes that you can pass to use to identify the table in the HTML. This is important and we will discuss more later.

Note, read_html only supports static page, i.e., javascript will NOT be executed.

attrs allows you specify the rules to match the tables in the HTML. For example, {'id': 'table'} means to find a table whose id is table. For the option table we are interested in, we should search for a table with class puts W(100%) Pos(r) list-options for put options or calls W(100%) Pos(r) Bd(0) Pt(0) list-options for call options.

So this is function we used to fetch option data:

def get_option_data(url: str, call_or_put: bool) -> pd.DataFrame:

"""Get the option data from table

Args:

url: yahoo url

call_or_put: if True, call table will be returned

"""

class_name = "puts W(100%) Pos(r) list-options"

if call_or_put:

class_name = "calls W(100%) Pos(r) Bd(0) Pt(0) list-options"

df = pd.read_html(url, attrs={"class": class_name})

if len(df) < 1:

raise RuntimeError(f"failed to retrieve data from {url} for {class_name}")

elif len(df) > 1:

print(f"{len(df)} sets of data is found, but 1 is expected")

return df[0]

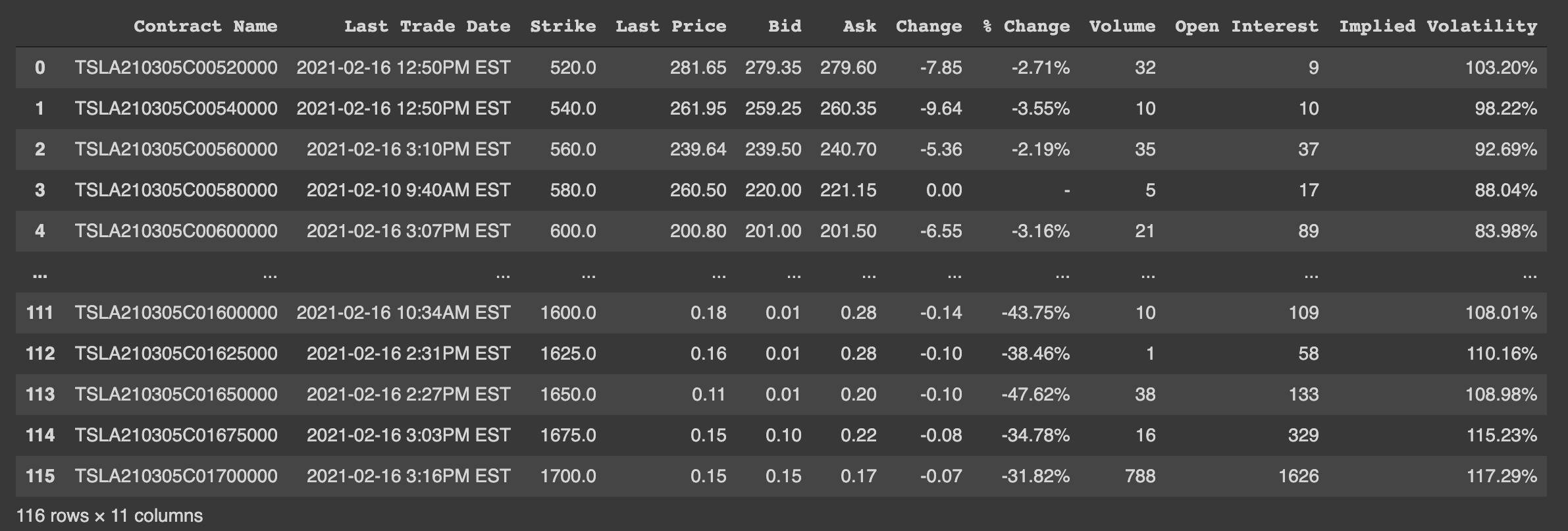

This is the sample outputs:

Process Data

We want to remove some outliers by filtering out the options which has very low volumne or open interest.

def remove_outlier(df: pd.DataFrame, current_price: float = None):

"""Some price of option are outlier and need to remove"""

# df = df.loc[(df["Change"] > 0.001) | (df["Change"] < -0.001)]

df = df.loc[df["Volume"] != "-"]

df["Volume"] = df["Volume"].astype(int)

df["Open Interest"] = df["Open Interest"].astype(int)

minimum_volume = (df["Volume"] + df["Open Interest"]).quantile(0.1)

return df.loc[(df["Volume"] + df["Open Interest"]) > minimum_volume]

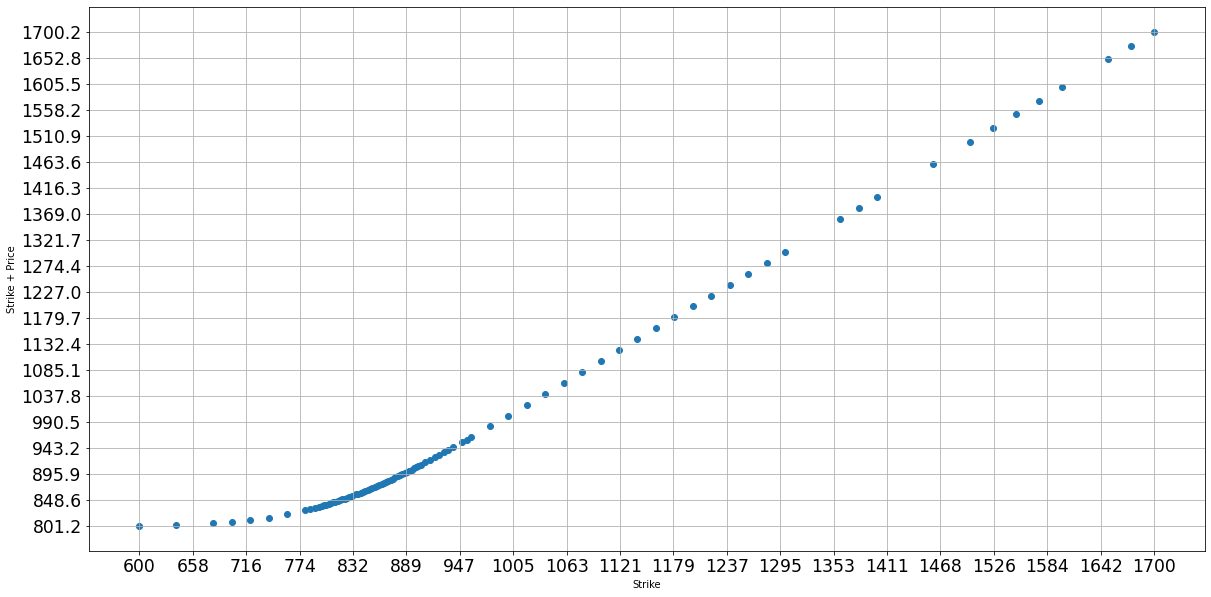

Then let us plot the curve of strike price vs break-even price (strike price + option price):

def plot_strike_profit(df: pd.DataFrame):

"""Plot the strick price vs profit price (strick + cost)"""

strike = df["Strike"]

profit = strike + 0.5 * (df["Bid"] + df["Ask"])

figure = plt.scatter(strike, profit)

plt.ylabel("Strike + Price")

plt.xlabel("Strike")

xticks = np.linspace(np.min(strike), np.max(strike), 20)

yticks = np.linspace(np.min(profit), np.max(profit), 20)

plt.xticks(xticks, fontsize="xx-large")

plt.yticks(yticks, fontsize="xx-large")

plt.grid(True)

return figure

Here we use 0.5 * (df["Bid"] + df["Ask"]) for the option price, as it is more stable than Last Price. This is the plot:

Or we could plot strike price vs option extrinsic value:

def plot_strike_extrinsic(df: pd.DataFrame, current_price: float, call_or_put: bool):

"""Plot the strick price vs extrinsic value

Args:

df: option data

current_price: current price of stock

call_or_put: if True, this is call option

"""

strike = df["Strike"]

# extrinsic = price of option if out of money or price of option - abs(strick - current_price)

if call_or_put:

extrinsic = 0.5 * (df["Bid"] + df["Ask"]) - np.maximum(0.0, current_price - df["Strike"])

figure = plt.scatter(strike, extrinsic)

plt.ylabel("extrinsic")

plt.xlabel("Strike")

xticks = np.linspace(np.min(strike), np.max(strike), 20)

yticks = np.linspace(np.min(extrinsic), np.max(extrinsic), 20)

plt.xticks(xticks, fontsize="xx-large")

plt.yticks(yticks, fontsize="xx-large")

plt.grid(True)

return figure

This plot matches the Black Scholes Model described in my previous post.

.png)

Some Useless Analysis

I also tried whether I could fit some lines to the curve of strike price vs break-even price.

.png)

Here is the code.

def fit_line_ransac(x: np.ndarray, y: np.ndarray, error_threshold: float = 1e-3, convergence: float = 0.9, max_iterations: int = 10, initial_sample_size=10):

"""Fit line via ransac"""

number_data = np.prod(x.shape)

sample_size = initial_sample_size

best_quality = 0.0

best_line = None

for i in range(max_iterations):

# random sample the points as initial seed

sampled_indices = np.random.choice(number_data, sample_size)

last_quality = 0.0

while True:

# fit a curve and find how many points lands on this curve

line = np.polyfit(x[sampled_indices], y[sampled_indices], 1)

error = np.abs(y - (line[0] * x + line[1])) / (np.abs(y) + 1e-3)

sampled_indices = np.where(error <= error_threshold)[0]

fit_quality = np.sum(error <= error_threshold) / number_data

if fit_quality - last_quality <= 1e-3:

# no more new points fitted to this curve

break

if sampled_indices.shape[0] < initial_sample_size:

# too less points lands on the curve

break

# refine the curve with all the points on this curve for robustness

last_quality = fit_quality

# print(f"Fit result at {i} iterations: {fit_quality * 100}% of data points fits to {line}")

if last_quality > best_quality:

best_line = line

best_quality = last_quality

# if most points fit to this curve, then we have found a good curve

# otherwise, try with a new random seed

if fit_quality >= convergence:

break

print(f"Best result: {best_quality * 100}% of data points fits to {best_line}")

return line

def detect_ankle_point(df: pd.DataFrame, current_price: float = None, error_threshold: float = 1e-3):

"""Fit two linear curve and find where it intersects"""

plot_strike_profit(df)

number_data = len(df)

strike = np.array(df["Strike"])

profit = np.array(df["Strike"] + 0.5 * (df["Bid"] + df["Ask"]))

# first curve for bottom 25% of points

if current_price is None:

x = strike[:number_data // 4]

y = profit[:number_data // 4]

else:

x = strike[strike <= current_price * 0.9]

y = profit[strike <= current_price * 0.9]

line1 = fit_line_ransac(x, y, error_threshold=error_threshold)

x = strike[[0, -1]]

y = line1[0] * x + line1[1]

plt.plot(x, y, color="r", linewidth=2)

# second curve for top 25% of points

if current_price is None:

x = strike[-(number_data // 4):]

y = profit[-(number_data // 4):]

else:

x = strike[strike >= current_price * 1.1]

y = profit[strike >= current_price * 1.1]

line2 = fit_line_ransac(x, y, error_threshold=error_threshold)

x = strike[[0, -1]]

y = line2[0] * x + line2[1]

plt.plot(x, y, color="g", linewidth=2)

# find the intersection

x = (line2[1] - line1[1]) / (line1[0] - line2[0])

y = line1[0] * x + line1[1]

plt.annotate(f"{x:.0f}, {y:.0f}", (x, y), fontsize="xx-large")

# change axis

plt.xlim(strike[[0, -1]] * np.asarray([0.95, 1.05]))

plt.ylim(profit[[0, -1]] * np.asarray([0.95, 1.05]))

plt.legend([

f"{line1[0]} * strick + {line1[1]}",

f"{line2[0]} * strick + {line2[1]}",

"Strike vs Strick + Price",

], fontsize="xx-large")

return line1, line2, (x, y)